Key Takeaways

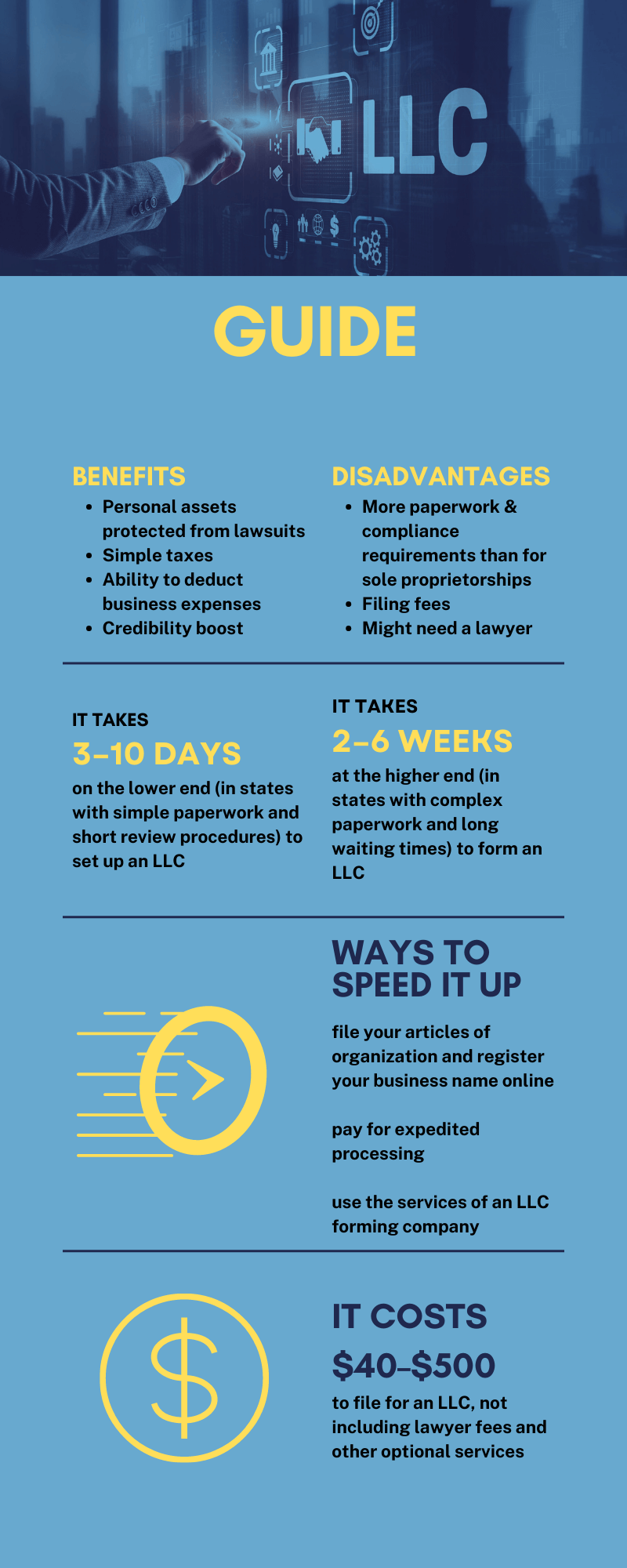

- The time it takes to create an LLC can range from 3 business days to several weeks.

- If you pay for expedited processing or use the services of a filing professional, you can expect it to be done sooner.

- The steps of LLC formation include: registering a business name, filing articles of organization, obtaining a review from the Secretary of State, appointing a registered agent, obtaining licenses and permits, and writing an operating agreement.

What Are the Benefits of Forming an LLC?

When you form a limited liability company, your personal assets are protected in case your business is sued. This means the court can only go after the assets of your business, not your personal assets like your house or car.

Another benefit of LLC filing is saving on taxes. When you file taxes as an LLC, you can deduct your business expenses, like travel and office supplies. It’s also possible to be taxed as an S corporation, which is exempted from federal income tax by passing all its income to its shareholders. That way, you’ll be protected from double taxation.

Finally, forming an LLC can boost your credibility with clients and suppliers. Because you’ve formed a legal entity, they see that you’re serious about your business.

Are There Any Disadvantages to Forming an LLC?

Before answering “How long does it take to set up an LLC?”, let’s think about the downsides. For one, there’s more paperwork and compliance requirements for an LLC compared to a sole proprietorship or partnership. To create an LLC, you’ll also have to pay filing fees and possibly hire a lawyer, which can increase your initial start-up costs.

Editor’s Note

A friend of mine, Mike, came to me one day and told me that he was feeling discouraged and stressed out by the LLC he had formed a few weeks earlier. He said things had been easier when he was a sole proprietor.

We talked about how a LLC can help him save money and protect his assets in the long run. With the help of a lawyer, Mike was able to get everything in order and even landed some great clients. Now, he’s running a successful business and is very proud of what he has accomplished.

What Is the Process of Creating an LLC?

There are 6 components of creating an LLC:

- Choosing a business name.

- Filing articles of organization.

- Obtaining a review from the Secretary of State.

- Appointing a registered agent.

- Creating an operating agreement.

- Obtaining licenses and permits.

Filing your articles of organization and registering your business name online will speed up the process. Double-check if you’ve completed all necessary steps so you don’t run into legal problems in the future. It’s a good practice to write an LLC operating agreement as well.

While the timing may vary by state, the LLC formation process is typically quick and easy. Let’s talk about exactly how long it will take to get your LLC approved.

How Long Does It Take to Set Up an LLC, Usually?

When you file the documents, they may be reviewed in as few as 3 days. The exact LLC processing time usually depends on which state you’re in and whether you use a service to expedite paperwork. Even if the state law requires longer procedures, it’s often possible to form your LLC within 7 to 10 business days.

How Much Does It Cost to Start an LLC?

How long does it take to set up an LLC? From three business days to a few weeks. But what about the costs? Here are the basics: state filing fees to create an LLC range from $40 to $500. Often, you can pay an additional fee for expedited processing. You’ll also need to appoint a registered agent – an individual or company that accepts legal documents on behalf of your LLC.

Conclusion: How Long It Takes to Form an LLC

Depending on how you go about it, your new company can be ready for action in as little as three days – no lengthy or expensive application processes here! Even if you choose a slower route and make plans to file documents yourself, establishing an LLC rarely takes more than four weeks.

Frequently Asked Questions

How Long Does It Take to Set Up an LLC in MO?

Getting your LLC off the ground in Missouri is easy – with just a few simple steps you could have it up and running within 2 to 4 weeks! However, for those who prefer using snail mail, be prepared for an extra wait time of 4–6 weeks.

How Fast Can I Create an LLC in Texas?

If you’re in a rush, Texas offers an accelerated process. For only $25 per document, the processing time is drastically decreased from 5-7 business days to just one!

Is Forming an LLC Difficult?

Getting an LLC off the ground is simple and straightforward – just make sure to have all your documents in order and meet legal requirements for formation of a limited liability company. If you need help with tax implications along the way, don’t hesitate to reach out to a knowledgeable advisor who can provide clarity.

What Is the Best Month to Start an LLC?

January is the traditional month to start an LLC, but you can begin at any time of year. Waiting until the new year begins lets you easily stay organized with all finances for tax purposes; key when it’s crunch-time come filing season.

How Long Does It Take to Approve an LLC in PA?

Expect it to take 4 weeks in Pennsylvania. However, if filing by mail is necessary, it may take up to 6 weeks – so leave yourself plenty of wiggle room!

Similar Posts:

- How to File a Complaint Against a Business: Consumer Advice

- How to Patent a Name for a Business: Trademarking a Business Name or Logo

- How to Get Rid of a 50/50 Business Partner? | Bad Business Partnership

- How to See If a Business Name Is Taken? Name Search Guide

- Why Is My Business Not Showing Up on Google Maps?